Commercial Solar Energy Incentives

Canadian businesses can access various rebates to help cover the cost of solar panel installation.

Clean Energy Investment Tax Credit

OpenOrganizations who make a clean energy investment between March, 28 2023 and 2035 are eligible for an investment tax credit refund. You can receive a tax credit of up to 30% on the capital cost of eligible solar generation and storage equipment.

Path to Savings

Discover the potential of your business with a commercial solar solution. Estimate savings, unlock rebates & financing options now.

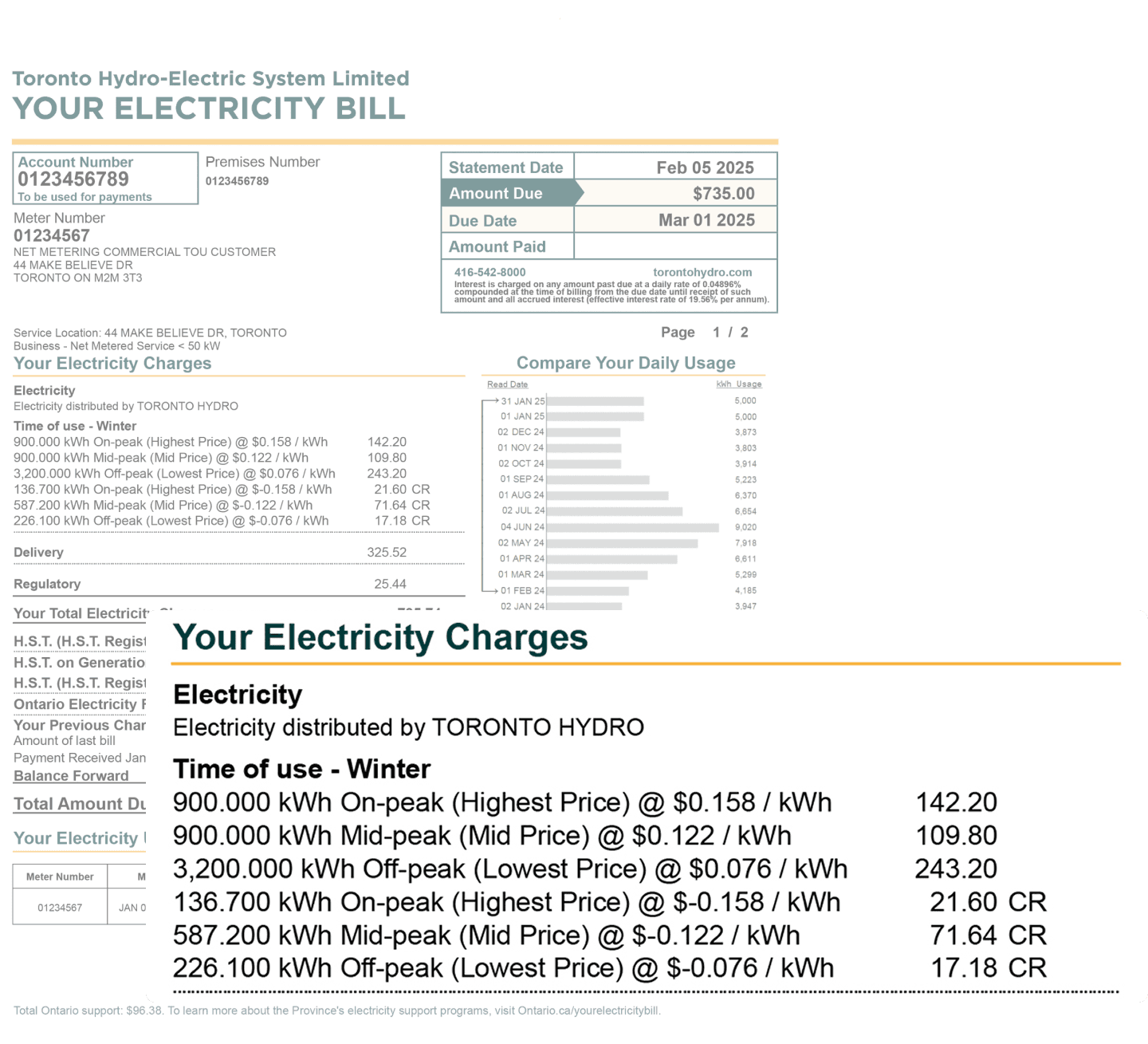

Your Estimated System Size

Range: 35kW - 51kW

Potential Savings

5 Years: $21,700

10 Years: $38,500

25 Years: $69,400

Needs Assessment

We start by understanding your energy needs, site conditions, and goals for solar installation.

Custom Design

Based on the assessment, a tailored system design will be created focusing on technical specifications and feasibility.

Proposal & Agreement

Deliver a comprehensive proposal that includes system performance estimates, financial analysis, and projected savings, followed by formalizing the agreement.

Planning & Permits

Develop a project plan and handle all necessary permits and approvals.

Installation & Commissioning

The experienced team will carry out the system installation, followed by thorough testing and commissioning. This ensures the system meets all project targets, adheres to industry standards, and functions as expected.

Handover & Warranty Start

Upon final inspection, comprehensive documentation will be provided and training sessions will be conducted to ensure seamless operation of the system. The warranty period will begin at this stage, ensuring long-term support and reliability.